The Nitty Gritty

Although the COVID-19 pandemic has highlighted its existence, most of us have been using fintech in some form or another for quite some time. It’s a big part of personal and business financial services in most of the world, with Ernst & Young’s Global Fintech Adoption Index of 2019 showing that 64% of the world’s population was using fintech applications in 2019, and 96% of global consumers were aware of at least one money transfer and payment fintech service. Global SME adoption was somewhat lower at 25%, but more than half of SMEs were using a banking and payments fintech service. Emerging markets tend to have the biggest uptake, but developed countries too are showing higher adoption rates, and the growth is faster than initially projected.

A somewhat vague concept due to the extent of tools and services it encapsulates, fintech, or financial technology, covers just about everything technological that might digitize, enhance or disrupt the more traditional financial services. It starts to get a little difficult to differentiate between traditional financial services and fintech these days because the two have become perpetually intertwined.

Where To Find It

From government bodies such as central banks and regulators to professional investors, disruptive startups and the long-established financial service companies, fintech’s role is growing, as is its funding. According to Statista, the Americas saw the number of fintech startups nearly doubling between 2018 and 2021, with the EMEA and APAC regions experiencing a tripling of the number of these businesses during the same period. Notably, fintech adoption rates are impacted by internet user penetration rates, specifically mobile internet usage, and trust of both tech firms and traditional financial services companies is influential.

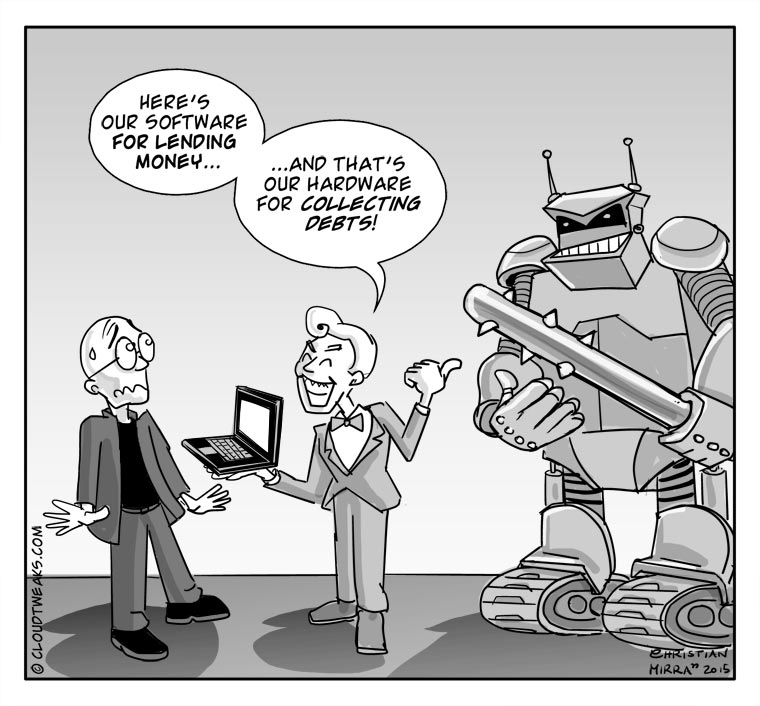

Along with its wide geographical reach, fintech touches a range of businesses from mobile payment platforms and consumer banking to insurance and cryptocurrency. In some forms as simple as an app that helps split the bill when out to dinner with friends, or streamlining today’s lending solutions, fintech also handles the extremely complex processes underpinning cryptocurrency exchanges, and both machine learning and artificial intelligence collect and analyze mounds of data to help traders and brokers make the best decisions they can. Unsurprisingly, digital payments currently take the lion’s share of total fintech transaction value, followed by challenger or neobanks (fintech organization that provide technologies which streamline mobile and online banking).

A Growing Market

(Infographic source: Toptal)

With constant improvements to technology, including enhanced accessibility and lower costs, businesses are becoming more productive, and the financial services sector (from chatbots, online banking, stock trading to instant payday loans online) has seen as much impact as everywhere else, if not more. Additionally, today’s customers expect their financial institutions to provide and make use of the most up-to-date and robust technological solutions, offering flexibility and keen insight which is, in fact, backed up by fintech services. Needless to say, the COVID-19 pandemic accelerated the adoption of fintech apps and services and even pushed some users to the more agile fintech services and away from traditional banks that were not yet ready to make necessary changes.

Regulation-wise, fintech organizations often do not have to comply with the same strict frameworks that traditional banks fall under; perhaps a double-edged sword. While relaxed regulations do allow for a more agile provision of services by fintech providers, many customers still have faith in the rigid models of the past and are hesitant to adopt the flashy new services, specifically when it involves their money. The financial crisis of 2008 has certainly impacted this stance sharply and as the fintech environment evolves fintech businesses are gaining a prestige of their own.

Forbes’ Fintech 50 List of 2022 highlights the breadth of the market, with top players noted in investment, real estate, blockchain and cryptocurrencies, insurance, business and personal finance. This list, however, is restricted to private companies with headquarters or substantial operations in the US, and the names are not yet familiar to us all. On the other hand, Statista’s list of largest fintech companies worldwide in 2021 tags brands such as Visa, MasterCard, Tencent and PayPal, reminding us that fintech is, in fact, very much part of our everyday lives. Expected to reach $332.5 billion in revenue by 2028 at a CAGR of 19.8% the global fintech market is tapping into both emerging economies’ potential and increased collaboration between national regulators and financial institutions, leaving no stone unturned and few lives untouched.

Trends and Technologies of Fintech’s Evolution

A range of technologies will drive fintech’s evolution and we can expect a few trends to emerge over the next decade. McKinsey estimates that artificial intelligence could generate up to a trillion dollars of additional value for the global banking industry annually, and automatic factor discovery will assist in the honing of financial modeling across the financial services sector. Analytics will continue to play a major role, though enhanced privacy protections and minimal use of data is likely to become the norm.

The role of IoT is expected to ramp up, with the automation of item identification through RFID labeling adding value and IoT communication solutions expanding and allowing for more intelligent communication with objects. Assisting with accurate risk prediction in both insurance and banking, IoT is also helping businesses meet environmental sustainability goals through indexing of carbon trading.

Distributed Ledger Technologies, some which uses blockchain to store and transmit data, will increasingly support ecosystem financing through storage of financial transactions in multiple places at once, and cross-chain technology that provides for blockchain interoperability will allow for the sharing and transmission of data across chains established on different protocols.

Thanks to Software-as-a-Service, opensource software and serverless architecture, speed and scalability will be more easily achieved, ensuring fintech solutions are rolled out as necessary. Cloud computing too is expected to play a significant role in the financial services industry with McKinsey’s research suggesting that effective use of the cloud can significantly reduce downtime and improve efficiency of infrastructure costs. Cloud computing trends of edge computing and edge cloud are now essential to financial services businesses, with cloud containers encouraging innovation and AI/cloud integration swelling.

Conclusion

The fintech landscape is broad and effective partnership between financial services firms and fintech providers continues. More and more banks are offering embedded solutions, while regulatory scrutiny increases, and ESG-focused fintech providers are expected to play a more important role. Fintech is firmly entrenched in the financial landscape and its significance will continue to mature.

By Jennifer Klostermann

Jennifer Klostermann is an experienced writer with a Bachelor of Arts degree majoring in writing and performance arts. She has studied further in both the design and mechanical engineering fields, and worked in a variety of areas including market research, business and IT management, and engineering. An avid technophile, Jen is intrigued by all the latest innovations and trending advances, and is happiest immersed in technology.